Life Insurance in and around Fort Wayne

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

It may make you uncomfortable to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to the people you're closest to.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Their Future Is Safe With State Farm

Having the right life insurance coverage can help loss be a bit less stressful for the ones you hold dear and give time to recover. It can also help cover important living expenses like utility bills, college tuition and home repair costs.

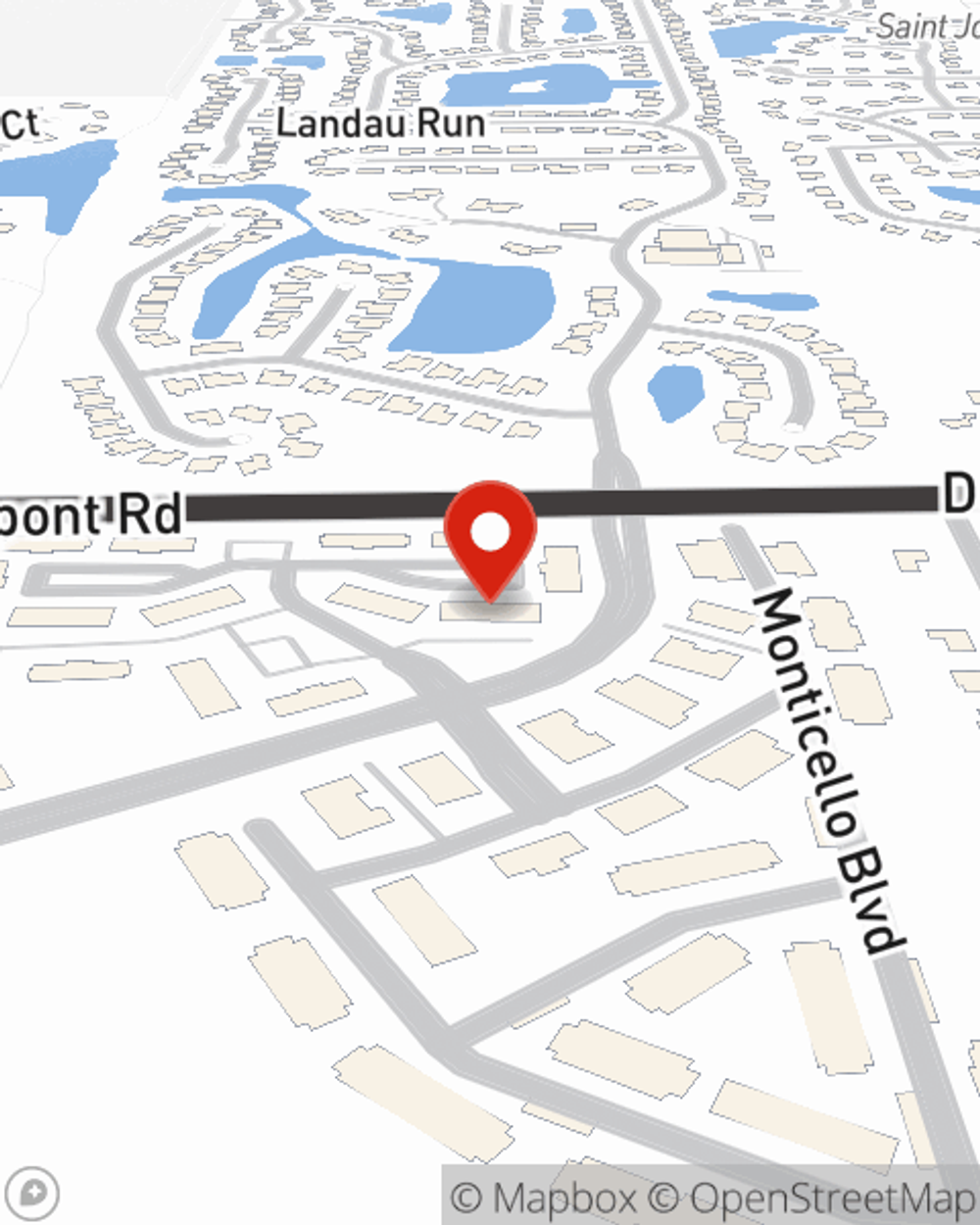

If you're looking for reliable protection and considerate service, you're in the right place. Visit State Farm agent Kent Paul today to find out which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Kent at (260) 478-2222 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.