Condo Insurance in and around Fort Wayne

Condo unitowners of Fort Wayne, State Farm has you covered.

Condo insurance that helps you check all the boxes

Condo Sweet Condo Starts With State Farm

There is much to consider, like savings options providers, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a hard decision. Not only is the coverage remarkable, but it is also competitively priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like videogame systems, linens and mementos.

Condo unitowners of Fort Wayne, State Farm has you covered.

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

Everyone knows having condominium unitowners insurance is essential in case of a windstorm, blizzard or ice storm. Adequate condo unitowners insurance can help if your condo is destroyed, so you aren’t stuck making payments for a home that isn’t habitable. One important part of condo unitowners insurance is its ability to protect you in certain legal situations. If someone slips because of negligence on your part, you could be required to pay for their lost wages or their medical bills. With the right condo coverage, you have liability protection in the event of a covered claim.

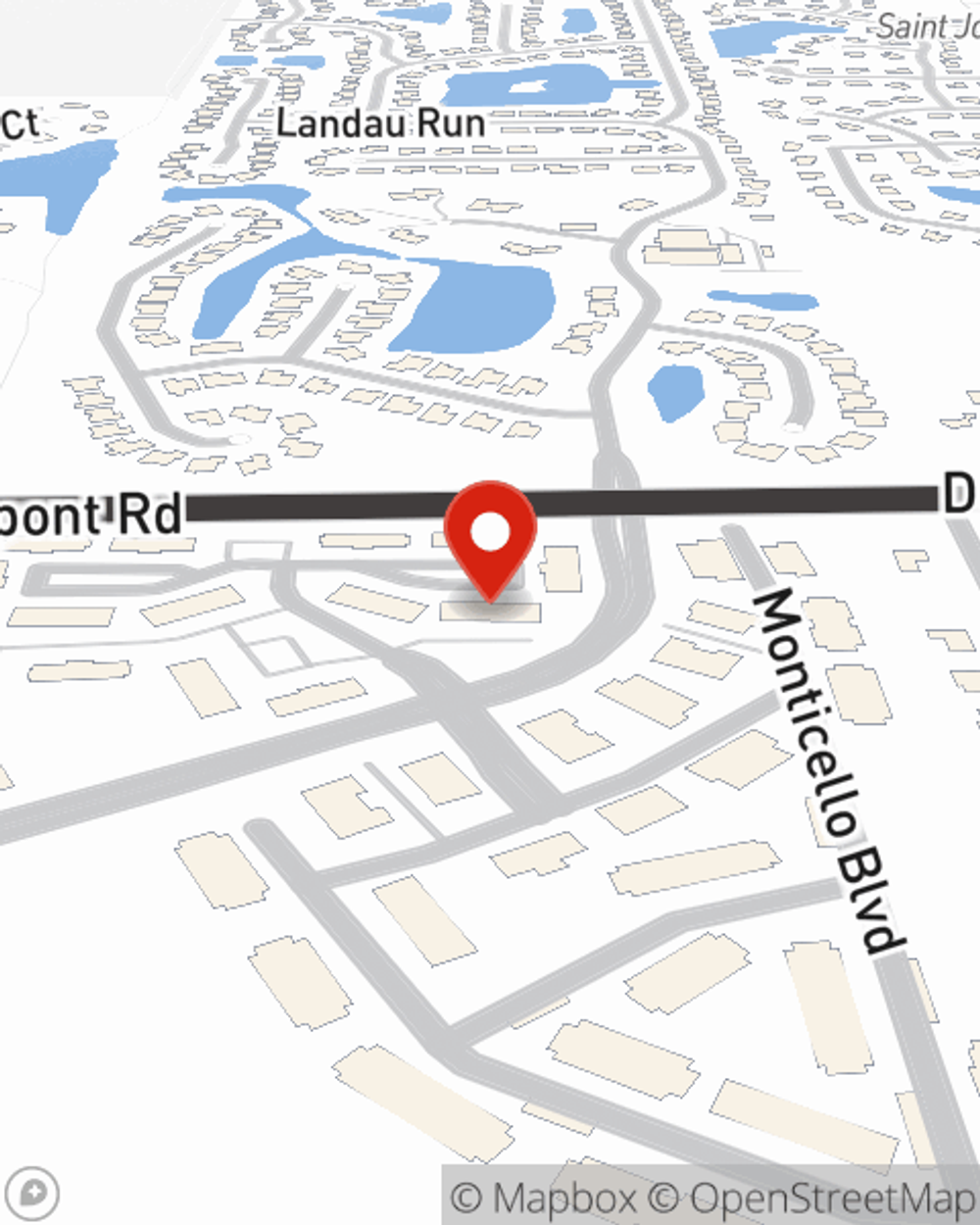

That’s why your friends and neighbors in Fort Wayne turn to State Farm Agent Kent Paul. Kent Paul can walk you through your liabilities and help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Kent at (260) 478-2222 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.